San Antonio Property Taxes Rate

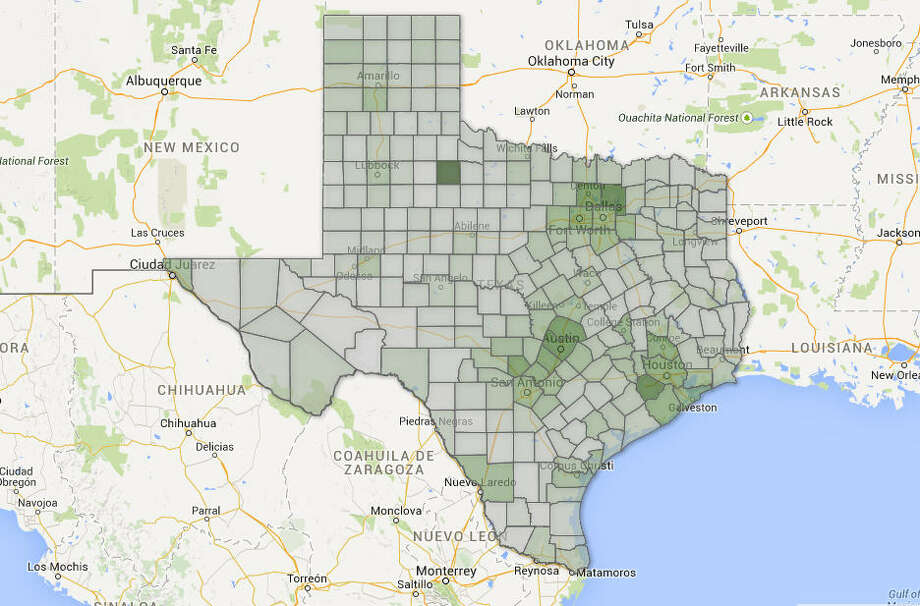

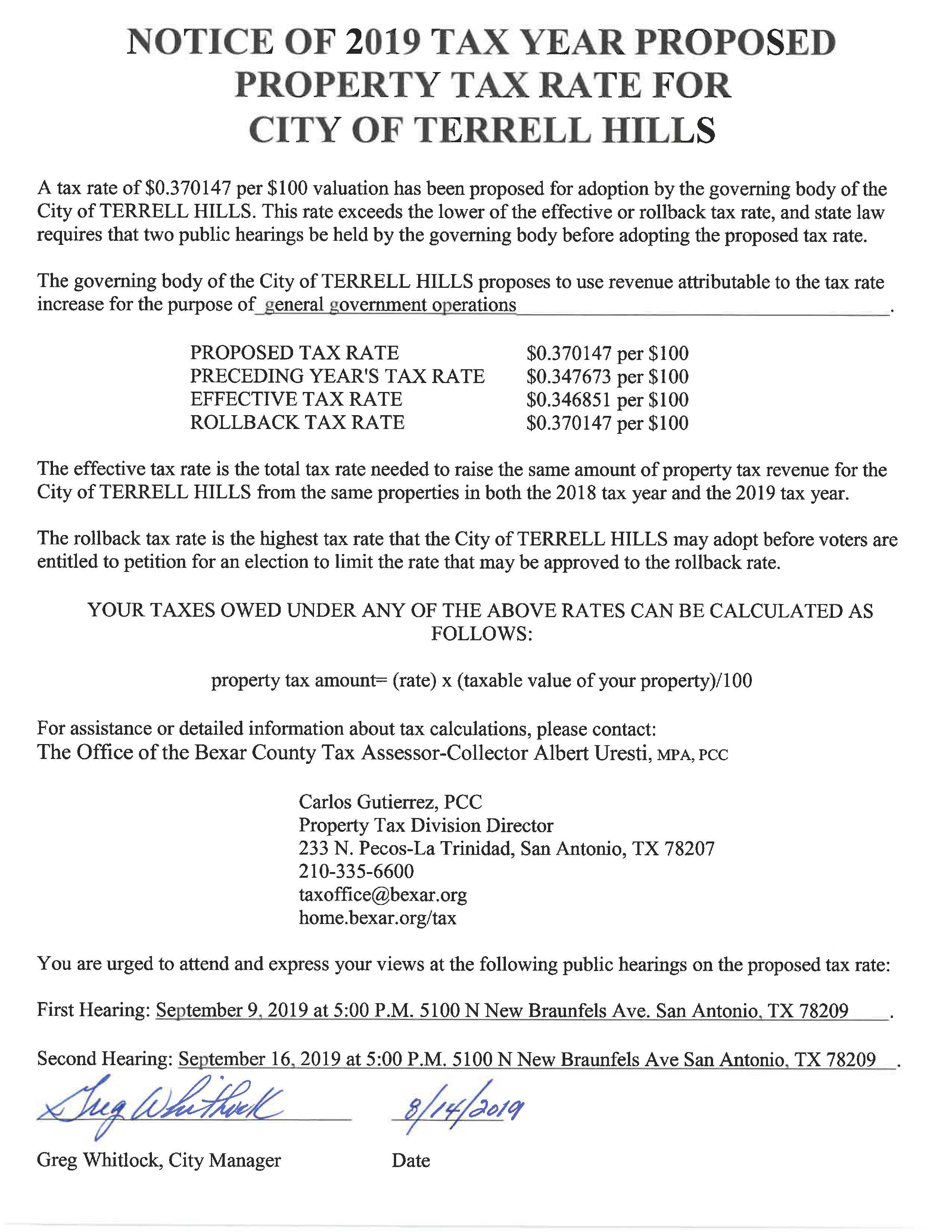

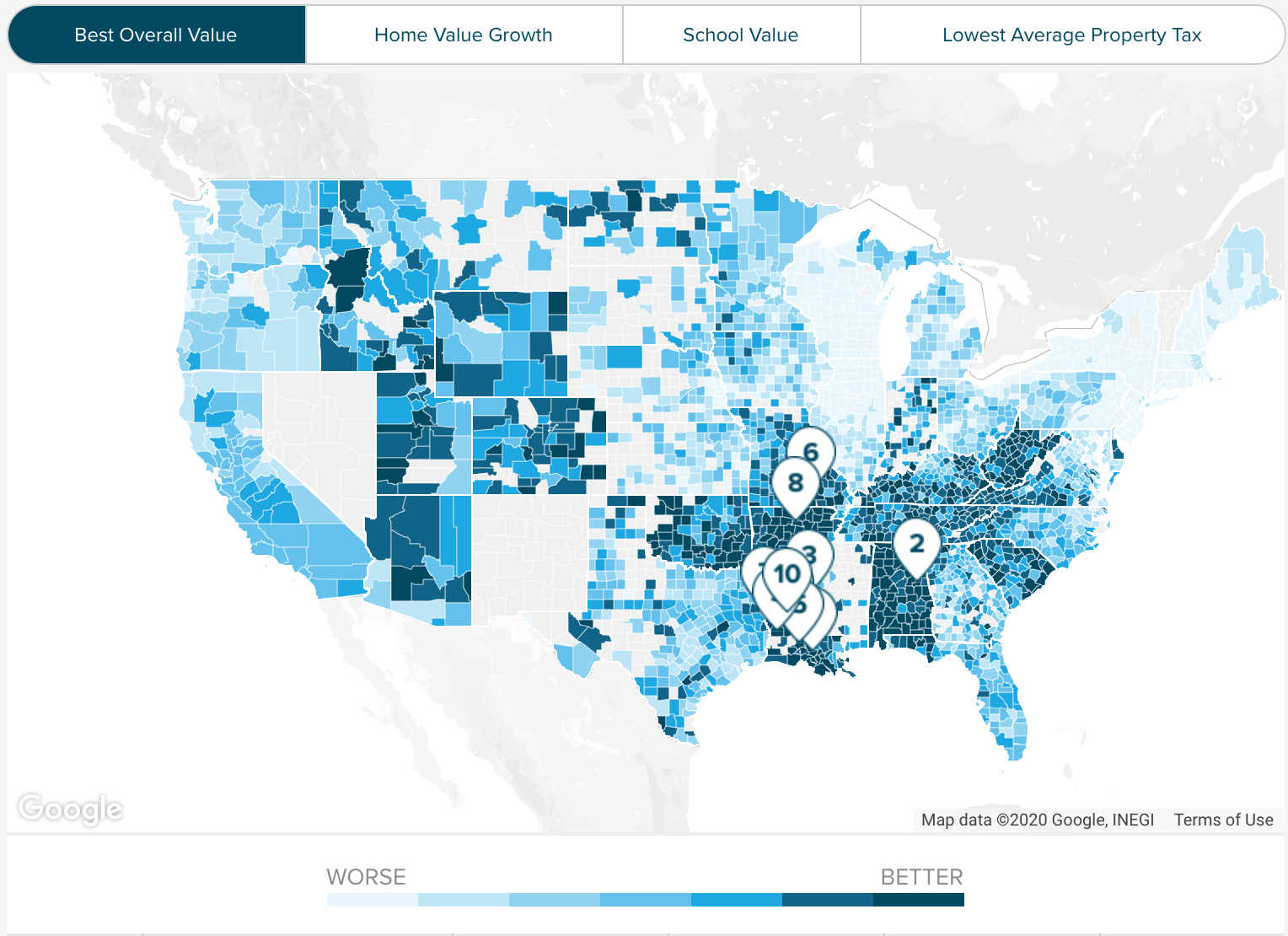

The following table provides 2017 the most common total combined property tax rates for 46 san antonio area cities and towns.

San antonio property taxes rate. That includes the city school and municipal utility rate but does not include any special districts. The average homeowner in bexar county pays 2828 annually in property taxes on a median home value of 142300. The median property tax in texas is 227500 per yearfor a home worth the median value of 12580000.

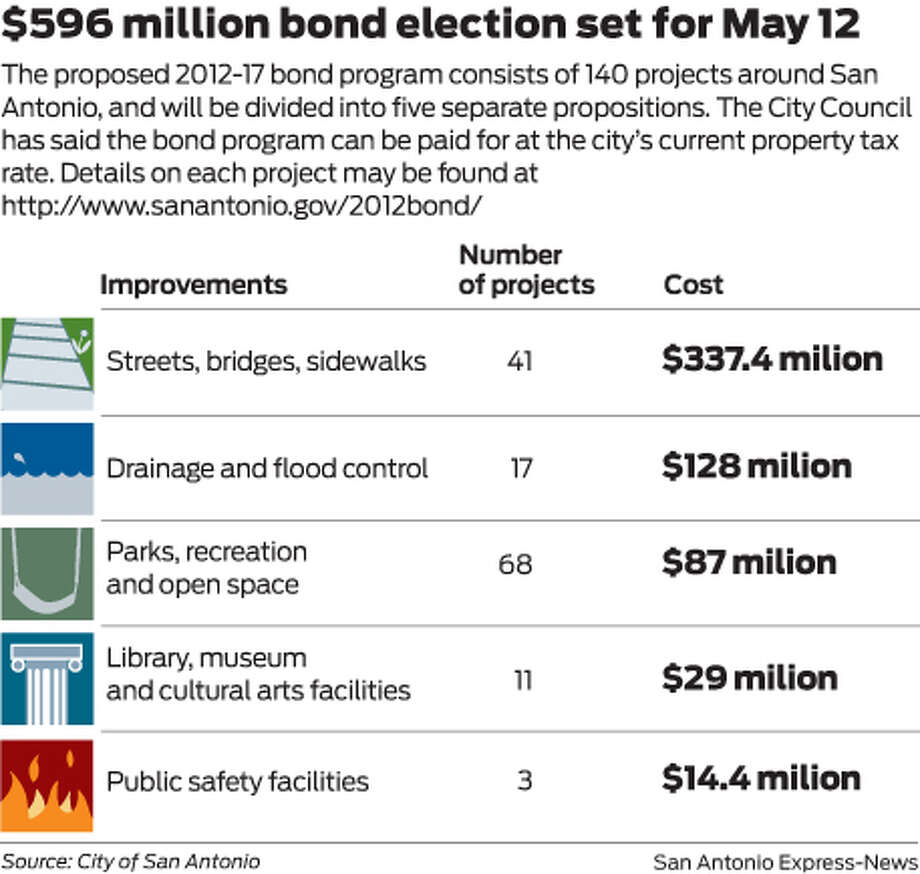

Information on property tax calculations and delinquent tax collection rates. Homeowners in neighborhoods such as alamo ranch timberwood park fossil creek redbird ranch and many others have historically fought in order to combat annexation by the city. Manager customer and public information.

2019 official tax rates exemptions name code tax rate 100. Deadlines and important tax dates. Information on taxes paying taxes and how to manage your taxes.

The taxable value of any property is typically not the same as the market value of the property. Truth in taxation summary pdf. Property tax department richard salas esq.

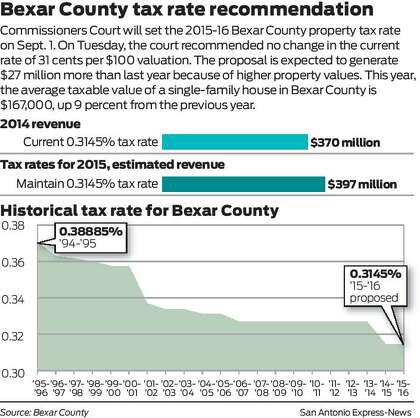

The property tax rate for the city of san antonio consists of two components. The fiscal year fy 2020 mo tax rate is 34677 cents per 100 of taxable value. City of san antonio property taxes are billed and collected by the bexar county tax assessor collectors office.

2019 official tax rates exemptions. The city of san antonio has an interlocal agreement with the bexar county tax assessor collectors office to provide property tax billing and collection services for the city. While san antonio is the largest city in bexar county more than a dozen other cities are competitive with the big kid on the block when it comes to property tax rates.

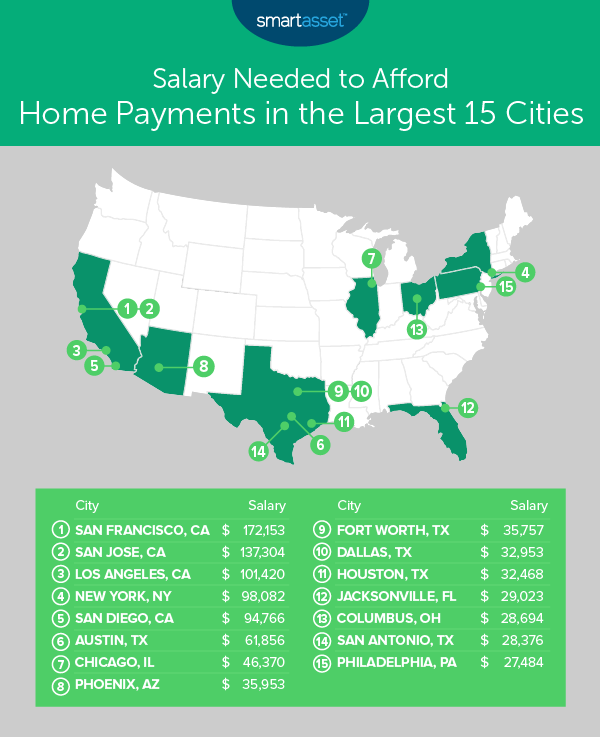

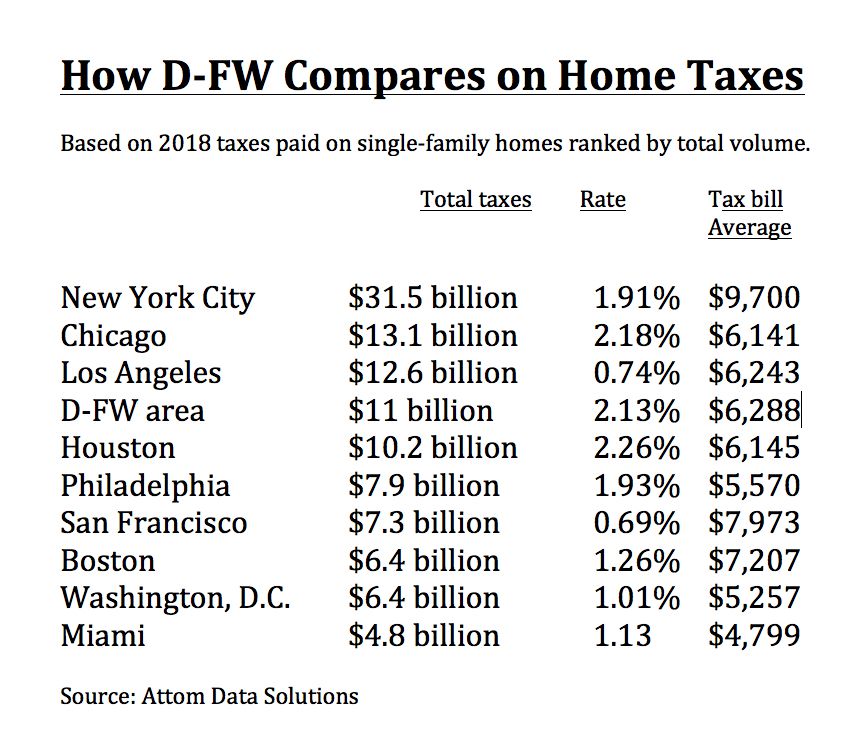

In san antonio the countys largest city and the second largest city in the entire state the tax rate is 274. Official tax rates exemptions for each year. Table of property tax rate.

Keeping in mind that san antonios city property tax rate is 55 per hundred dollars eliminating this line item could be huge and it is in many areas. Tax amount varies by county. For 2018 officials have set the tax rate at 34677 cents per 100 of taxable value for maintenance and operations.

Maintenance operations mo and debt service. Property taxes for debt repayment are set at 21150 cents per 100 of taxable value. 100 dolorosa san antonio tx 78205 phone.

/https://static.texastribune.org/media/files/2c80fe77f6e2a3c06be6bd8c4a7baeeb/06%20Glenn%20Hegar%20Biennial%20Revenue%20Estimate%20MG%20TT.jpg)

/static.texastribune.org/media/files/ee8928ddb39a124ebbb377c3bd9cfade/Austin%20Thunderbirds%20Flyover%20EG%20TT%2010.jpg)